- Financial performance reflects a challenging year

- Balance sheet strength retained

- Strong annual growth in customer accounts

- Ambition to become the UK’s best community bank

Summary:

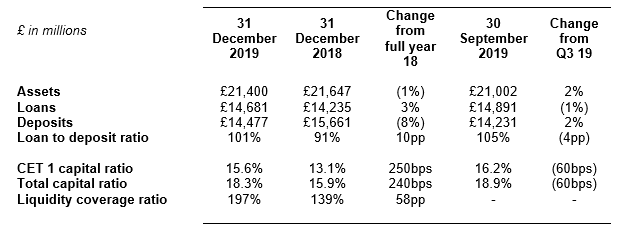

| · | Underlying loss before tax of £11.7 million (2018: £50.0 million profit) reflecting balance sheet strengthening actions, IFRS 16 impact and debt interest expense. | |

| · | Statutory loss before tax of £130.8 million (2018: £40.6 million profit) primarily reflecting a £68 million write-down of intangible assets (no impact on regulatory capital). |

|

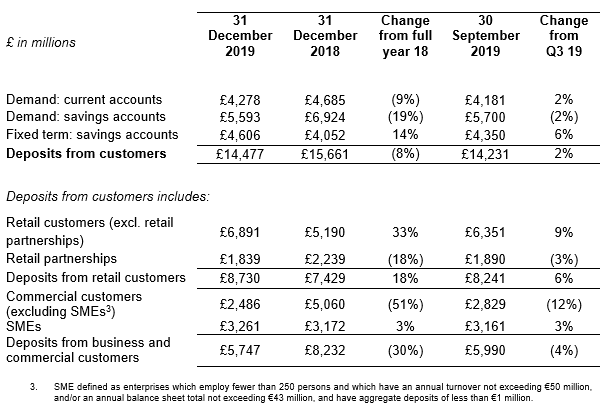

| · | 21% growth in retail and SME core deposits to £10.2 billion (2018: £8.4 billion). |

|

| · | Net fee and other income up 43%, driven by customer growth and the launch of fee-earning services. | |

| · | Strong capital position with Common Equity Tier 1 (CET1) ratio of 15.6% (2018: 13.1%). | |

| · | Surpassed 2.0 million customer accounts (2018: 1.6 million). | |

| · | Rated no. 1 for service in stores and for online and mobile banking1. |

|

| · | Strategic ambition to become the UK’s best community bank. | |

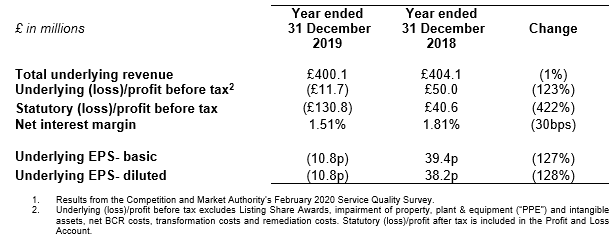

| · | Strategic plan revised to achieve statutory RoTE >8.5% by 2024:- Deliverable cost and revenue initiatives identified and being implemented, complemented by targeted investments, with returns further enhanced through balance sheet optimisation |

|

Key Financials:

Dan Frumkin, Chief Executive Officer at Metro Bank, said:

“Our financial performance reflects a very challenging year for Metro Bank. External headwinds, internal challenges and actions we took to put the business on a more positive trajectory are reflected in the results. Despite this, Metro Bank’s market-leading service proposition continued to deliver growth in customer accounts, and our balance sheet ended the year in a materially stronger position. We’ve fully evaluated our strategy, and have a clear plan which will return the bank to sustainable growth built around a community banking model. An enhanced focus on costs, improved productivity, and investment in our infrastructure will enable our deposit-led franchise to deliver profitable growth over the medium term. Thanks to the steadfast commitment of colleagues across the bank, I am confident we will successfully execute against these priorities to become the UK’s best community bank.”

Strategic update and outlook

1. Tight cost control through back office efficiencies and organisational simplification. Metro Bank’s fixed costs make up a significant portion of its cost base, primarily due to the store network; this in time will deliver significant operating leverage and drive revenue. In the meantime, the bank has initiatives in place to ensure cost growth continues to moderate. New stores will become more cost efficient and flexible in size, fit-out and leasing terms. The bank will also streamline its back-office operations by relocating to cost effective locations, modernise contact-centre technology, aim to digitise/automate services and reduce organisational layers across the bank. 2. Improve capability and meet more customer needs through better execution. Metro Bank intends to maintain and improve its leading customer service to both deepen existing relationships and attract new FANS with the aim of driving revenue and NIM growth. The current product offering will be enhanced and broadened, and the bank will invest in its colleagues and technology to enhance accessibility for customers. A limited number of new stores will be opened over the next few years, allowing Metro Bank to be embedded in more communities. Existing and new stores will benefit from the new marketing campaign which will raise awareness of Metro Bank’s award-winning service. 3. Continued infrastructure investment to support the transformation. Continued investment in Metro Bank’s leading customer proposition with the aim of bringing the physical and digital world together, making life easier for FANS and colleagues. This will be underpinned by further investment in technology, finance and risk infrastructure. 4. Optimise our balance sheet. Metro Bank will optimise its balance sheet and asset mix whilst focusing on risk adjusted return on regulatory capital. In the short-term, tactical asset disposals will be considered, and in the longer term a number of funding diversification options will be considered to deliver greater risk adjusted returns on capital. The bank will seek a better yielding asset book and improved returns on regulatory capital by rebalancing its lending mix towards areas such as specialist mortgages, SMEs and unsecured loans. 5. Clear and refreshed external and internal communications strategy. Metro Bank’s refreshed strategy will focus on providing colleagues, shareholders and other stakeholders with a clear message. Internally, the bank will ensure colleagues have a clear understanding of its transformation plan and their role within this. Externally, the bank is re-evaluating guidance, KPIs, tone and frequency of reporting. |

Guidance and Targets

BCR Capability & Innovation Fund Award

|

|

|

|

|

|

o Metro Bank will continue to spend ~£2 of its own funds for every pound it receives from the Capability & Innovation Fund o Metro Bank will open a total of 15 rather than 30 stores in the North of England by 2025 o Metro Bank will continue to build a range of game-changing digital capabilities to help SMEs thrive |

|

|

o Metro Bank will step away from niche SME propositions that benefit a smaller group of SMEs, including secured lending transformation, virtual accounts and pooling; it will re-phase a further three initiatives to create near-term capacity for transformation. |

|

|

Financial performance for the year and quarter ended 31 December 2019

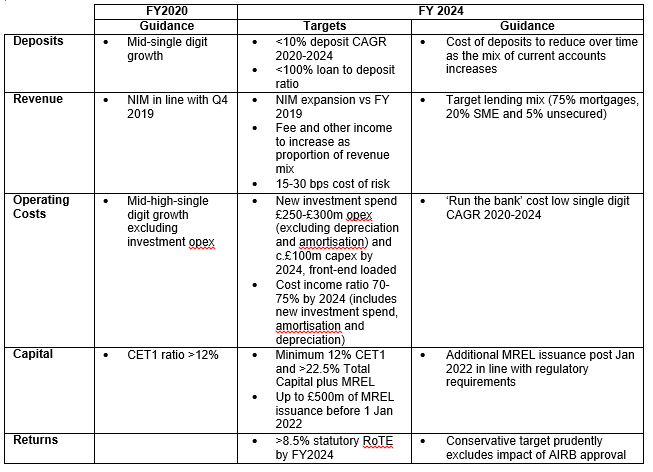

Deposits

|

|

Strong customer account growth of 385,000 in 2019 (2018: 403,000) to over 2 million. |

|

|

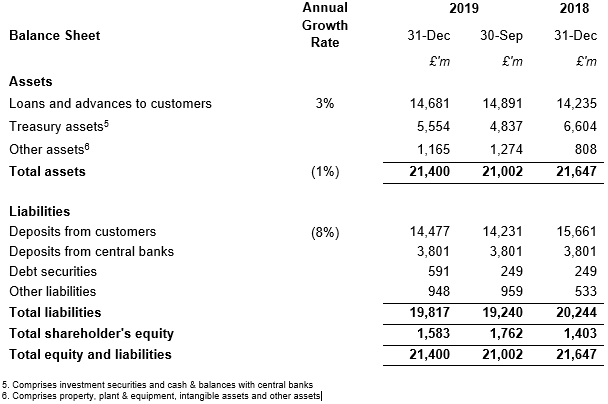

Total deposits were £14,477 million as at 31 December 2019. A net reduction in deposits in H1 was followed by a 6% increase in the second half, supported by strong growth in fixed term retail savings accounts and growth in SME balance. |

|

|

Deposits increased in the fourth quarter (£246 million), as expected. Deposits from personal and small business customers continued to demonstrate resilience throughout the year. |

|

|

Cost of deposits was 78bps for the full year up from 61bps in 2018 due to pricing actions taken during the year. |

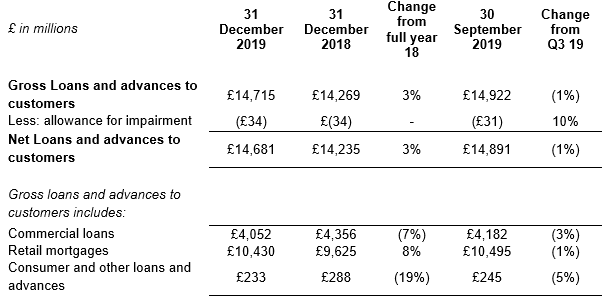

Loans

|

|

Total net loans as at 31 December 2019 were £14,681 million, up from £14,235 million at 31 December 2018, reflecting proactive management of lending growth. Loan balances contracted marginally in the fourth quarter (down 1%). |

|

|

Retail mortgages remained the largest component of the lending book at 71% of gross lending (31 December 2018: 67%). |

|

|

Loan to deposit ratio at 101% is above the prior year (31 December 2018: 91%), although below the 109% reported at H1, reflecting the bank’s actions to reduce the loan to deposit ratio in a controlled way. |

|

|

Asset quality remains strong, with full year cost of risk remaining low at 0.08% (31 December 2018: 0.07%). Non-performing loans remain low, although increased to 0.53% (31 December 2018: 0.15%) reflecting seasoning of the loan portfolio and a single name commercial exposure, the loan portfolio remains highly collateralised. |

Profit and Loss Account

|

|

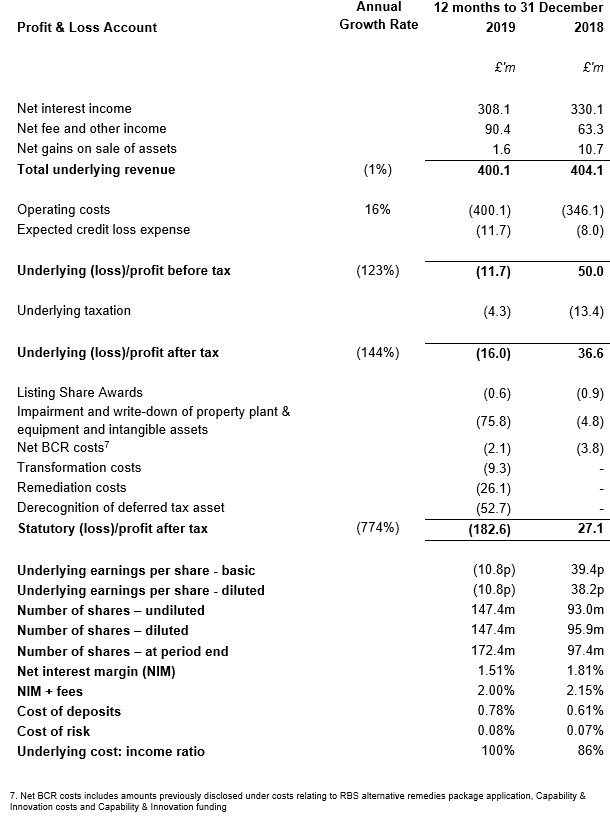

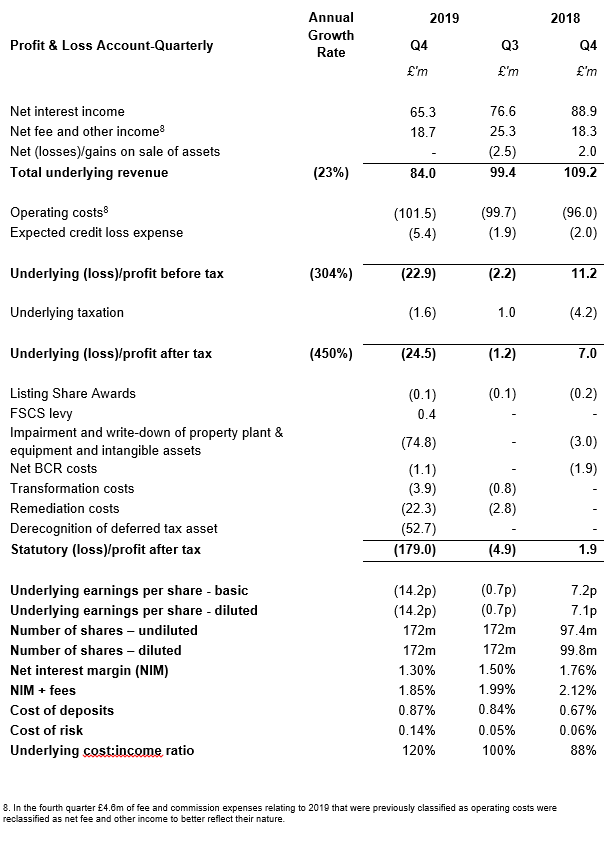

Net interest margin of 1.51% compared to 1.81% in the prior year, with the decline primarily reflecting actions taken to maintain a resilient balance sheet, including a £521 million loan portfolio disposal, £1.5 billion of treasury asset sales and higher deposit costs. The movement also reflects the impact of IFRS 16 lease accounting as well as continued pricing pressure in the mortgage market. The issuance of MREL in October 2019 in order to comply with interim MREL requirements contributed to a decline in the margin. |

|

|

Net interest income down 7% to £308.1 million (2018: £330.1 million) reflecting the movements in NIM described above. These actions, including a moderation of loan growth, reduced revenue by c.£12m in Q4 2019. |

|

|

Net fee and other income was up 43% in the year driven by customer growth, addressing fee leakage and the launch of new fee earning services and products. |

|

|

Underlying cost:income ratio increased to 100% year-on-year from 86% in 2018, largely reflecting net interest income headwinds. The pace of cost growth slowed significantly in the second half of 2019 compared to the rate of growth in the second half of the previous year. |

|

|

Underlying loss before tax for the year was £11.7 million, compared to a profit of £50.0 million in 2018, reflecting the income challenges and cost pressures outlined above. Loss in the fourth quarter increased to £22.7 million. |

|

|

Statutory loss before tax of £130.8 million in 2019 (2018: £40.6 million profit) including: - Write-down of intangible assets (£68 million): relating to the discontinuation of certain work-in-progress or older IT projects that do not form part of the bank’s revised strategy. This does not impact the bank’s capital position as intangible assets are excluded from regulatory capital. - Transformation costs (£11 million): costs associated with the delivery of the cost transformation programme. - Remediation costs (£27 million): including work relating to the January 2019 risk weighted assets (“RWA”) adjustment and associated regulatory investigations which are ongoing, as well as work undertaken in relation to a previously disclosed review of the bank’s sanctions procedures. |

|

|

Statutory loss after tax of £182.6 million in 2019 (2018: £27.1 million profit) that includes a £53 million derecognition of the bank’s deferred tax asset for unused tax losses. This is an accounting non-cash item and does not impact regulatory capital or liquidity. The derecognition reflects the impact on the bank’s short-term results of its investments announced as part of its strategy update. |

Capital, Funding and Liquidity

|

|

Strong liquidity and funding position maintained, reflecting H2 2019 deposit growth of £774 million, a £521 million loan portfolio disposal and £1.5 billion treasury asset sales. As a result, the bank’s Liquidity Coverage Ratio was 197% as of 31 December 2019 (2018: 139%), compared to the bank’s requirement of 100%. |

|

|

Total capital as a percentage of risk-weighted assets was 18.3%. Following the £350 million senior non-preferred debt issuance in October, total capital plus MREL resources were £2,018 million with a total capital plus MREL ratio of 22.1% at 31 December 2019, above the 21.5% 1 January 2020 interim MREL plus buffers requirement. |

|

|

CET1 capital of £1,427 million as at 31 December 2019 was 15.6% of RWAs (2018: 13.1% and Q3 2019: 16.2%), compared to the bank’s Tier 1 regulatory minimum of 10.6%4. |

|

|

RWAs as at 31 December 2019 were £9,147 million (2018: £8,936 million and Q3 2019: £9,242 million). |

|

|

Regulatory leverage ratio of 6.6% (2018: 5.4%). |

Customer Experience

|

|

Expanded coverage, opened a store in Manchester in the fourth quarter and new stores in Wolverhampton, Cardiff and Hammersmith in early 2020. Metro Bank now has 74 stores. |

|

|

Enhanced digital offering, launched Business Insights and MCash in the fourth quarter. These new services use the latest technology to improve Metro Bank’s attractive product offering for SME customers. |

Board Changes

|

|

Vernon Hill stepped down from his role as Chairman in October and from the Board on 17 December 2019. Sir Michael Snyder has been appointed as Interim Chairman, while the recruitment process for a permanent Chair progresses. |

|

|

Craig Donaldson stepped down at the end of the year as CEO and will remain available to the Board as an advisor until the end of 2020. |

|

|

Dan Frumkin, who joined Metro Bank in September 2019 as Chief Transformation Officer, was appointed to the Board as Interim CEO from 1 January 2020 and confirmed as CEO on 19 February 2020. |

|

|

Monique Melis, who joined the Board in June 2017, has been appointed as Interim Senior Independent Director with effect from 1 December 2019, following the appointment of Sir Michael Snyder as Interim Chairman. |

|

|

After 10 years on the Board, Alastair 'Ben' Gunn, stepped down as Deputy Chairman and Non-Executive Director with effect from 31 December 2019. |

|

|

Sally Clark joined the Board on 1 January 2020 as an independent Non-Executive Director. Most recently, Sally was Chief Internal Auditor at Barclays plc where she was responsible for driving the vision and strategy for the internal audit function. |

Change of approach to quarterly reporting

Going forward, as the bank focusses on its new strategy and associated transformation plans, the bank will report full and half year results in line with UK practice, with short form trading updates at Q1 and Q3. These updates will include deposit and loan balances, together with a short commentary covering the performance of the business in the period.

Metro Bank PLC

Summary Balance Sheet and Profit & Loss Account

(Unaudited)

For more information, please contact:

Metro Bank PLC Investor Relations

Jo Roberts

+44 (0) 20 3402 8900

jo.roberts@metrobank.plc.uk

Metro Bank PLC Media Relations

Tina Coates / Abigail Whittaker

+44 (0) 7811 246016 / +44 (0) 7989 876136

Teneo

Charles Armitstead / Haya Herbert Burns

+44 (0)7703 330269 / +44 (0) 7342 031051

Metrobank@teneo.com