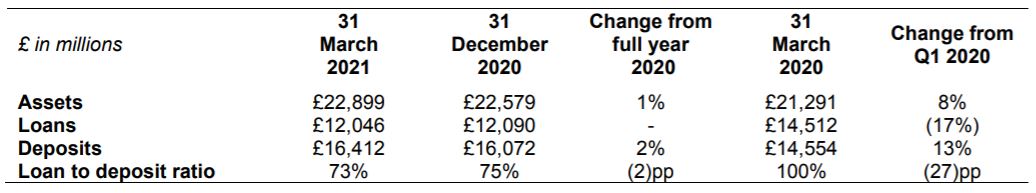

Q1 total deposits of £16,412 million were 2% above the full year position, with continued mix improvement driven by growth across business and retail customers’ instant access and current accounts, together with a reduction in higher-cost fixed term deposits. As previously stated, maintaining a high-quality deposit mix rather than expansion remains the focus for 2021.

Q1 total net loans were broadly flat at £12,046 million with strong growth in consumer lending supported by the integration of the RateSetter platform and continued growth in capital-efficient government-supported business lending, offset by the attrition of lower-yielding residential mortgages and commercial term loans. Credit impairments continued to be benign and in line with guidance provided at the full year. The marginal reduction in loan to deposit ratio in Q1 to 73% reflects deposit growth since the year end, while the year-on-year decrease includes the mortgage portfolio disposal and increase in deposits during the period. The £3.1 billion mortgage portfolio disposal successfully completed on 2 February created capital headroom, as well as excess liquidity that is currently suppressing net interest margin.

Delivery of the five strategic priorities continues at pace, including completion of the £337m RateSetter back book acquisition on 2 April and roll-out of unsecured personal lending through the RateSetter platform across all channels, including stores on 12 April. The range of higher-yielding specialist mortgages has also expanded to include near prime and 95% loan to value residential mortgages.

Customer activity dipped in January following the introduction of the third national lockdown in late December, recovering as the quarter progressed and helped by the gradual easing of restrictions in April.

Daniel Frumkin, Chief Executive Officer at Metro Bank, said:

“Metro Bank has delivered a solid first quarter, with continued improvement in deposit mix. We are also beginning to see progress across our loan book, with strong growth in consumer lending and specialist mortgages as we focus on assets delivering higher risk-adjusted returns. Our turnaround strategy is ongoing and I remain incredibly grateful for how colleagues have continued to step-up to deliver for our customers and communities during these challenging times.”