Metro Bank means business

Join the thousands of successful businesses who entrust us with their banking. You’ll value our relationship-based approach, listening and responding to your business needs, goals and aspirations. We’re beside you at every stage of the journey.

Whether you’re a small business, a large corporation, or somewhere in between, you can depend on us to meet your commercial banking needs.

Bank accounts

Make your everyday business banking easy with accounts designed to be simple and straightforward.

Savings Accounts

Make your money work for you with savings accounts to manage your extra cash.

Lending Options

Help your business prosper with our credit, loan, asset and invoice financing options. T&Cs and eligibility criteria apply.

Switch to us in 7 days and enjoy 31 months* of:

- no monthly account maintenance fees

- no charges on eligible transactions

- fee-free cash paid in, paid out, and exchanged up to £10k per month

- no minimum balance requirements.

- an optional savings rate on a Business Instant Access account.

*Fees will apply after 31 months. Please note that other charges including overdrafts, international payments and CHAPS are not included in this offer. Please review carefully the Important Information Summary and BCA Full Switcher Terms and Conditions documents for information and a breakdown of all charges that apply. You will have the option to access an enhanced savings rate on a Business Instant Access account. Terms and Conditions apply.

Metro Bank Scam Checker powered by Ask Silver*

Metro Bank is the first British bank to partner with AI scam checker Ask Silver. Help protect yourself from fraudsters with our easy-to-use Metro Bank Scam Checker.

*Subject to WhatsApp and scam checker availability. The checker may miss things. You may need to consider acting without delay, such as contacting your bank. Metro Bank won't charge you for your call or data. However, you may be charged by your service provider.

Commercial referrals for intermediaries and brokers

We offer tailored commercial lending solutions through a range of products and structures.

Commission is paid on successful referrals.

Why choose Metro Bank for your Business Banking?

-

Our expert Local Business Managers are in all our stores across the UK to help with your business banking needs, from everyday banking to securing funding and more

-

Apply for a Business Bank Account in-store for same day account opening, in most cases.

- Our Business Bank Account and Business Credit Card have been independently Rated Five-Stars by Moneyfacts in June 2025, for stand-out features in the marketplace.

Ways to bank with us

Business banking made easy. You choose how you want to bank with us - whether that’s face-to-face in one of our stores, online or in our 5-star rated App*.

In store

There’s an LBM in every store to support with your business banking needs.

Online Banking

Easy to use online banking. We offer flexible online banking options so you can choose the best one for your business.

Mobile App

The Metro Bank App is free to use and available to our Business Bank Account customers. Make payments and manage your accounts and cards on the go.

Post Office®

Not close to a store? Access your account for a range of services at a Post office®near you.

Supporting our business customers

Best of British Business

We’re featured in Business Reporter’s Best of British Business campaign, in partnership with The Independent, which celebrates outstanding British companies and leaders driving excellence and contributing to the UK economy.

Fiona Hornsby decided to take the leap and become her own boss. She now runs two award-winning pubs in Liverpool.

Dr Sipra Deb secured Recovery Loan Scheme funding to grow her childcare business.

Invoice It

A digital tool designed to help small businesses and sole traders get paid quickly and securely.

Supporting women in business

Access to resources and networking opportunities for our female business community.

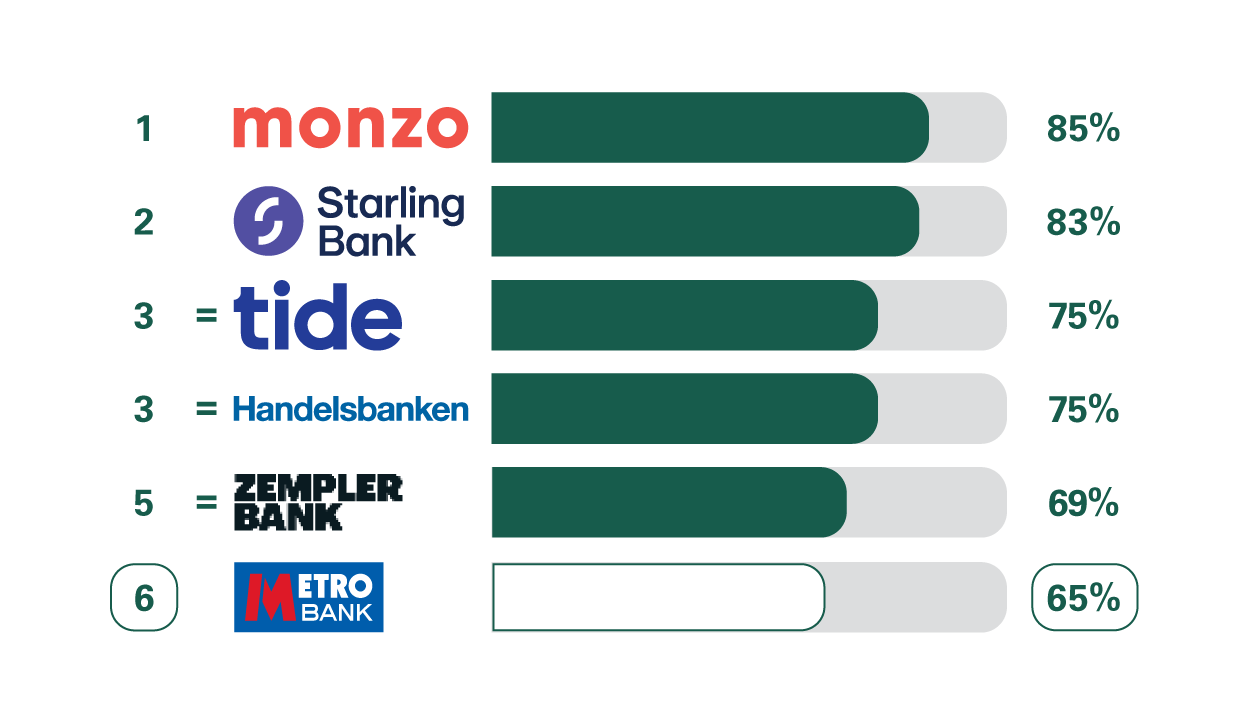

Independent service quality survey results

Overall service quality

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1200 customers of each of the 16 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs^). The results represent the view of customers who took part in the survey.

Ranking

See the full business service quality survey results

Independent CMA survey carried out in Great Britain, January 2024 to December 2024 – Overall Service Quality. Results at www.bva-bdrc.com.

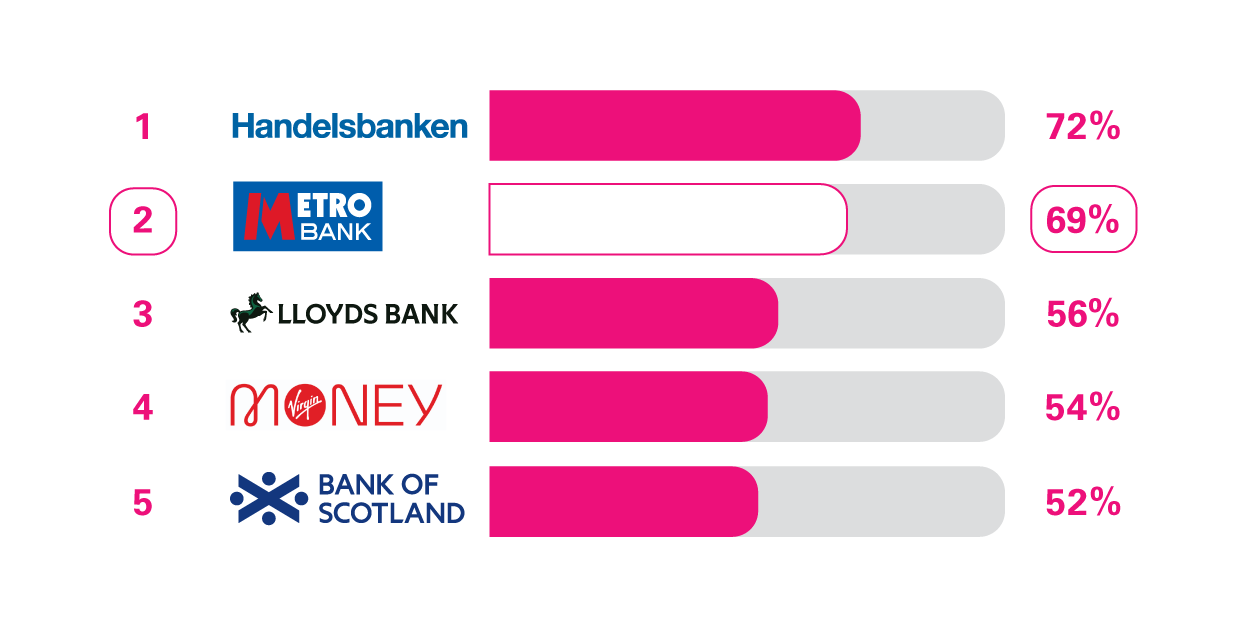

Services in branches and business centres

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1200 customers of each of the 16 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs^). The results represent the view of customers who took part in the survey.

Ranking

See the full business service quality survey results

Independent CMA survey carried out in Great Britain, January 2024 to December 2024 – Service in branch. Results at www.bva-bdrc.com.

Important information

* Metro Bank App rating on Apple’s UK App Store 7th October 2025.

^ SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).