Business And Commercial Overdrafts

An overdraft could help with your short term cash flow

A little extra cushion for your business

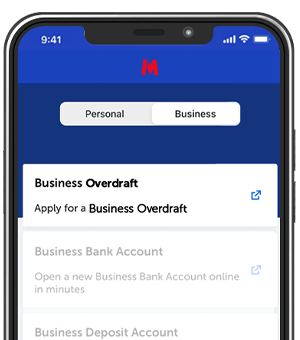

For a Business Overdraft up to £60,000 you can apply in the Metro Bank App, or come into store to talk through the options of a flexible arranged overdraft.

Transparent fees

Our fees are upfront – you’ll know your rate and your arrangement fee. And interest will only be charged on what you borrow

Straightforward application process

It’s quick and easy to apply and we’ll tell you straightaway if you’re eligible

Annual reviews

We’ll review your account annually to make sure your overdraft is working the way it should

Applying for a Business Overdraft

You can apply for a Business Overdraft up to £60,000 in the Metro Bank App or in store.

Applying for a Commercial Overdraft

For commercial overdrafts over £60,000, contact your Relationship Manager or Local Director. Find their details alongside your local store.

It only takes a few minutes to apply for a Business Overdraft in our appInstall or open the Metro Bank App. Go to 'Products and Services' and then 'Business'. Select 'Business Overdraft' and follow the instructions. We’ll let you know instantly if you’re eligible and the funds will be applied to your account the same day. Terms and conditions apply. |

|

Business Overdraft

Business Overdraft

| Minimum limit | Interest rate | Arrangement fee |

|---|---|---|

| £100 | 14.70% EAR |

1.75% or £50, whichever is greater. There are no fees on overdrafts up to and including £500 |

Interest and fees on your Business Overdraft

Show Business Overdraft fees and interest Hide Business Overdraft fees and interest

| £100 to £25,000 | £25,001 to £60,000 | £60,001 and above | |

|---|---|---|---|

| Interest rate | 14.70% EAR (variable) per year | Agreed when you apply | Agreed when you apply |

| Arrangement fee |

1.75% or £50 (whichever is greater) There are no fees on overdrafts up to and including £500 |

1.75% or £50 (whichever is greater) | Agreed when you apply |

| Term | Up to 12 months (renewed yearly) | Up to 12 months (renewed yearly) | Up to 12 months (renewed yearly) |

| Other fees | Security fees, valuation fees, legal fees and/or administration fees may be charged | Security fees, valuation fees, legal fees and/or administration fees may be charged | Security fees, valuation fees, legal fees and/or administration fees may be charged |

| Renewal fees | A renewal fee of 1.25% will be charged (minimum £50). There are no fees on overdrafts up to and including £500 | A renewal fee of 1.25% will be charged (minimum £50) | A renewal fee of 1.25% will be charged (minimum £50) |

Additional charges

- Unarranged Business Overdraft interest: 25% EAR (variable) per year.

- £25 charge for unpaid item (when you don’t have funds to cover a cheque, direct debit or standing order payment and we have to return it unpaid)

- £15 charge for paid item (when a cheque, direct debit or standing order is deducted from your account and creates an unarranged overdraft)

We review your Business Overdraft – usually annually – and may charge renewal fees.

We usually need a personal guarantee from you, and may also ask you for other forms of security. We reserve the right to withdraw an overdraft at any time.

Your property may be repossessed if you do not keep up repayments on an overdraft that your home is securing

Eligibility

You can apply for an overdraft if you have our Business Bank Account.

Business overdrafts can be useful for managing your short-term cash flow. You can arrange an overdraft in store with your Local Business Manager.

We’ll carry out a credit check and make a decision depending on your financial status.

Any property used as security, which may include your home, may be repossessed if you do not keep up repayments on a loan or other debt secured on it.

See what you need to open a business account

Interest on Business Overdrafts

Arranged overdrafts up to £25,000 have a variable interest rate of 14.70% EAR. This rate may be varied from time to time on giving you not less than two month’s written notice

For overdrafts over £25,000, we’ll agree either a fixed or variable margin with you that’s above the Metro Bank Base Rate.

Interest will be calculated daily on your account and applied monthly. The amount of interest payable and when it will be charged will be shown on your monthly statement.

Read more about EAR Read more about EAR

EAR stands for equivalent annual rate – the rate you’d pay if your account stayed overdrawn for a year. It takes into account the interest rate you’re charged when you go overdrawn, how often it’s charged, the effect of compounding – charging interest on interest – on your debt, and the Bank of England base rate. Interest is calculated daily and charged monthly. Your monthly statement will show how much interest you’ll pay and when. The EAR does not take into account future changes to the Bank of England base rate. The EAR does not include any fees or charges that apply to your overdraft. Charges for unarranged overdrafts or for going over your agreed overdraft limit will be shown separately.

Commercial Overdraft

Commercial Overdraft

| Minimum limit | Interest rate | Arrangement fee |

|---|---|---|

| None | Tailored | Tailored |

We usually need a personal guarantee from you, and may also ask you for other forms of security. We can withdraw an overdraft at any time.

Your property may be repossessed if you do not keep up repayments on an overdraft that your home is securing

Eligibility

You can apply for an overdraft if you have our Commercial Current Account.

Commercial overdrafts can be useful for managing your short-term cash flow. You can arrange an overdraft in store with your Relationship Manager. We’ll carry out a credit check and make a decision depending on your financial status.

Any property used as security, which may include your home, may be repossessed if you do not keep up repayments on a loan or other debt secured on it.

See what you need to open a commercial account

Interest on Commercial Overdrafts

All our interest rates for Commercial Overdrafts are tailored to suit your needs.

Get all the details on our Business Overdraft

Download our PDF to read when you like – it contains all the ins and outs of our Business Bank Account and overdrafts.

Business Bank Account Overdraft Details (PDF) (184KB)

Business Bank Account Details (PDF) (275KB)

Our Service Relationship with Business Customers (PDF) (1.1MB)

Get all the details on our Commercial Overdraft

Download our PDF to read when you like – it contains all the ins and outs of our Commercial Current Account and overdrafts.

Commercial Current Account Details (PDF) (862KB)

Our Service Relationship with Business Customers (PDF) (1.1MB)

FAQs

Am I eligible for a Business Overdraft?

Yes, if you:

- are over 18 and a UK resident

- have a Metro Bank Business Bank Account

- are a director with at least 20% ownership of the business

- don’t have diplomatic immunity and are not subject to sanctions

- haven’t been declared bankrupt or entered into a company voluntary arrangement

- aren’t an existing commercially-managed Metro Bank business customer with a dedicated Commercial Relationship Manager

and your business:

- is registered in the UK as a sole trader, limited company (ltd) or a limited liability partnership and has been trading for at least seven months

- has an annual turnover of no more than £40 million and a balance sheet of no more than £34.4 million

- has no more than £800,000 worth of exposure with Metro Bank (excluding loans secured on residential properties the business owns) and doesn’t owe us more than £250,000 of business borrowing currently

- doesn’t have a CBILS or RLS loan with us or any other bank

- has less than 25% of capital or voting rights controlled by a public body

- doesn’t operate in industries we don’t offer loans to: gambling (non-government-approved), adult entertainment, arms and military, and marine and aviation.

Can I apply for an overdraft when I open my Business Bank Account?

No, you’ll have to wait three working days from the day you open your Business Bank Account before applying for any lending. This is the same whether you opened your account online or in store.

If I already have an overdraft with Metro Bank, can I switch to the new Business Overdraft?

If you want to switch to the new Business Overdraft, you’ll need to repay your existing overdraft and reapply. There are a few things to bear in mind:

- we can’t guarantee upfront that you’ll be granted a new limit of equal or higher value than the one you already have

- in certain circumstances, you might not be approved for a new overdraft

- once you have paid off your existing overdraft, we can’t re-open it.

How can I check if I’m eligible?

Read through the eligibility section of these FAQs, and chat to your Local Business Manager if you’re not sure.

Can I have a loan and a Business Overdraft?

Yes, you can have both a business loan and a Business Overdraft, as long as you meet the eligibility criteria – check at the top of this section.

Can I borrow more than £60,000?

You might be able to get a higher limit if you can provide a security as a guarantee. To chat about this, contact your Local Business Manager.

Your ways to bank

Online

Metro Bank 24/7. Check balances, make payments, see transactions and open new accounts any time - all with internet banking.

Mobile

Control your money on the move with our mobile banking app. Check balances, move money, make payments and more wherever you are.

In-store

A friendly face and a quick answer. And all the usual payment services too. We're open 362 days a year.

By phone

Talk to a real person in our UK contact centre. Click the button below to check when we're available.

Some more things you may like...

Accounts

Business Loans

With loan terms from 1 to 5 years, you can choose the loan that’s right for your business. And for loans under £25,000 there’s a fixed rate and no arrangement fee.

Borrowing with us

Business credit cards

Get one low rate and free European card transactions – plus no annual fee.

Borrowing with us

Growing your business

Choose the right finance option to nurture and expand your business.

Business banking

Opening an account

Opening a business account with us is straightforward and hassle-free especially when you're prepared.