This is Relationship Banking

We believe that relationships are important and that everyone deserves a great experience throughout their financial journey. Our service is built upon human connection and real, long-standing relationships – whether it’s face to face, over the phone, online, or on our App.

Banking accounts

From current accounts to savings and mortgages, our personal banking range is designed to cover everything you need.

Business bank accounts

From straightforward bank accounts to asset finance, we’ve got the know-how to help you with your needs.

Protecting your money

Your eligible deposits with Metro Bank are protected by the FSCS.

Metro Bank Scam Checker powered by Ask Silver*

Metro Bank is the first British bank to partner with AI scam checker Ask Silver. Help protect yourself from fraudsters with our easy-to-use Metro Bank Scam Checker.

*Subject to WhatsApp and scam checker availability. The checker may miss things. You may need to consider acting without delay, such as contacting your bank. Metro Bank won't charge you for your call or data. However, you may be charged by your service provider.

Why Metro Bank?

Relationship Banking

We’re the first new high street bank in over 100 years. Our mark was made in London, but since then we’ve set up shop all across the capital and beyond.

Our store opening hours

Come and see us in store. Please check the latest opening hours for each of our stores before you visit us.

Your pocket-sized bank

Log in to our app with your face or fingerprint, and manage your accounts with a tap. Plus, track your spending with our Insights feature.

We’re extending our Saturday store opening hours

Stores open on a Saturday are now open from 9.30am to 4pm. To find out if your local store is open on a Saturday, click below:

First-ever Champion of Women’s and Girls’ Cricket

We’ve partnered with the England and Wales Cricket Board (ECB) to set up a new Women’s and Girls’ Fund, to break down barriers and create more opportunities for women and girls in the sport.

Give us a call

If you have an enquiry relating to any of our stores, products or services, please get in touch to speak to someone in our UK-based contact centre and we’ll be happy to assist you.

Current Account Switch Guarantee

Switching to us is fast and easy with the Current Account Switch Service.

Our service quality

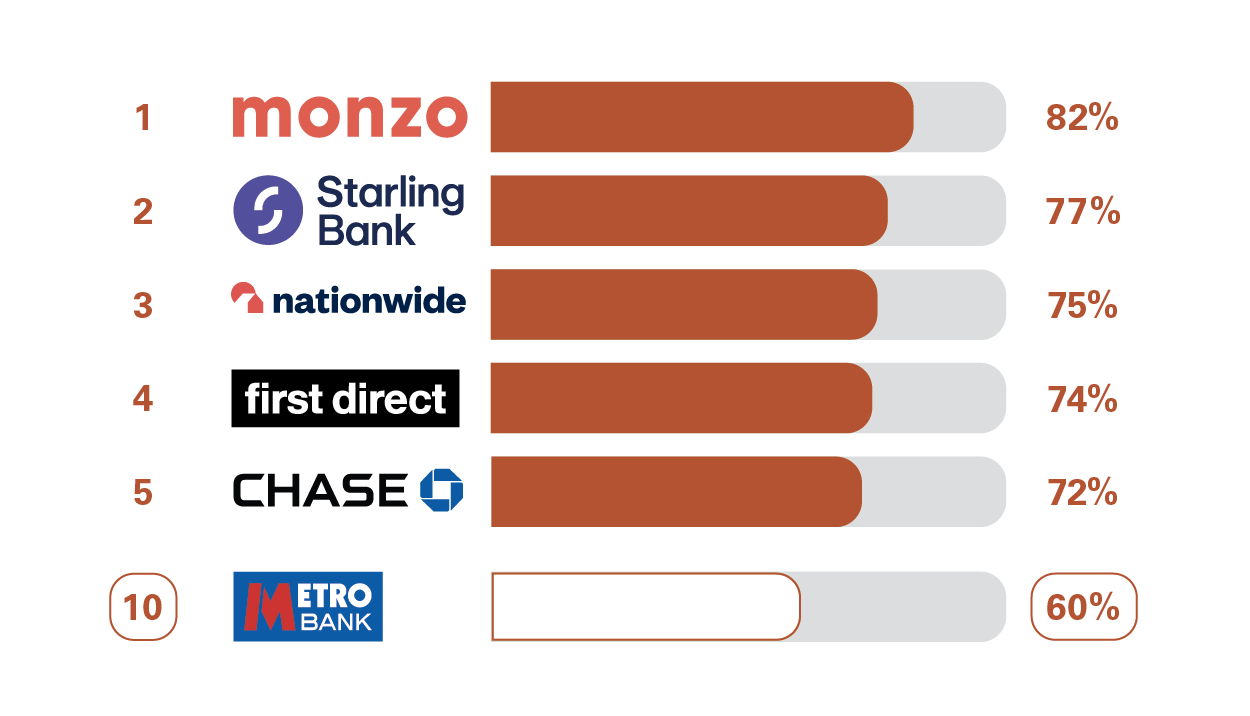

Independent service quality survey results | Personal

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1000 customers of each of the 17 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Overall service quality

See the full personal service quality survey results

Independent CMA survey carried out in Great Britain, January 2025 to December 2025 – Overall Service Quality. Results at www.ipsos.com/en-uk/personal-banking-service-quality.

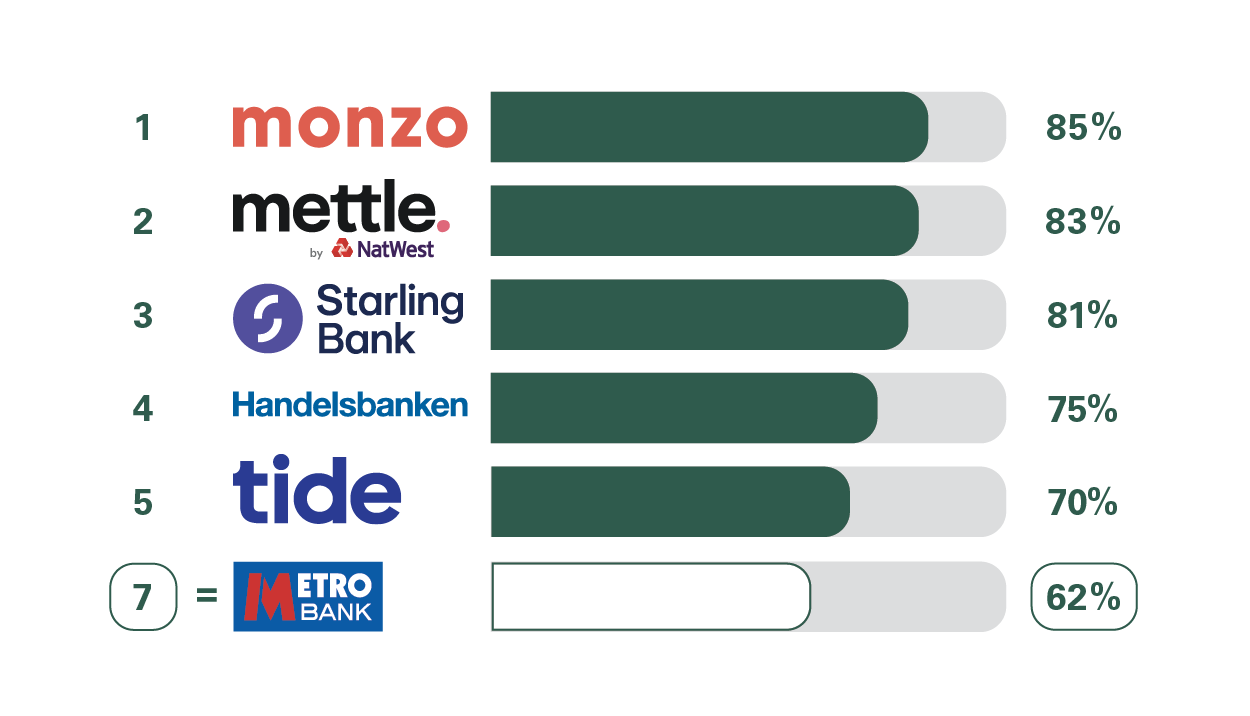

Independent service quality survey results | Business

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1200 customers of each of the 17 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

Overall service quality

See the full business service quality survey results

Independent CMA survey carried out in Great Britain, January 2025 to December 2025 – Overall Service Quality. Results at www.ipsos-mori.com.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

Authorised push payment (APP) scams rankings in 2024

Authorised push payment (APP) scams happen when someone is tricked into transferring money to a fraudster’s bank account. Information about Metro Bank’s performance prior to the introduction of the reimbursement requirement in October 2024 can be found in PSR’s latest APP Scams Performance Report published in February 2026.