Highlights

- Turnaround plan successfully delivering momentum and sustainable growth, underpinning the path to profitability

- Improving lending mix and maximising risk-adjusted returns on capital

- Margin expansion, NII growth and fee recovery driving revenue growth

- Enabling sustainable growth through strong cost control and improving operating jaws

- Targeted infrastructure development to improve resilience and protect the Bank

- Management remains focused on execution with clear steps to breakeven - Continued focus on customers, communities and colleagues, voted #1 high street bank for overall service, supported local communities with government-backed loans and successfully transitioned colleagues to a hybrid working model whilst maintaining the Bank’s strong culture

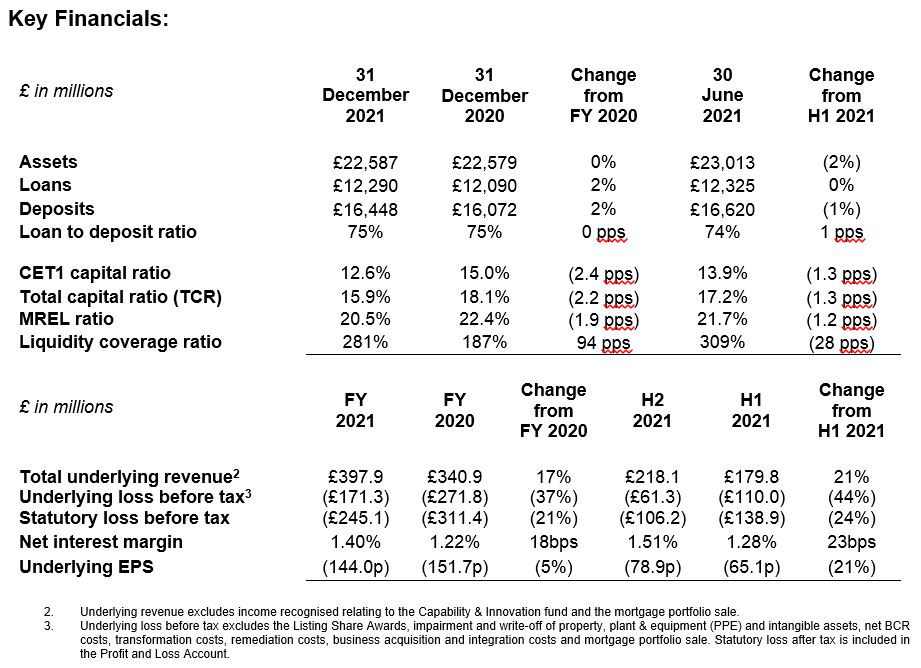

- Underlying revenue increased by 17% to £397.9 million reflecting the shift towards higher yielding assets, lower cost of deposits and a recovery in customer activity.

- Underlying costs of £546.8 million reflect management actions to control cost, deliver positive operating jaws and leverage the fixed cost base, underlying operating costs reduced 1% in the second half

- Underlying loss before tax reduced by 37% to £171.3 million, a second half underlying loss of £61.3 million is down 44% on the first half, highlighting the momentum towards profitability

- Statutory loss before tax of £245.1 million following settlement of the PRA investigation, provisioning for the FCA investigation, sanctions related remediation and non-recurring expense items that underpin the path to profitability such as restructuring and legacy fixed asset impairment

Daniel Frumkin, Chief Executive Officer at Metro Bank, said:

“Two years into the turnaround, our strategy is delivering meaningful results as we move towards profitability. In a changing macro-economic environment, we have accelerated the shift of our balance sheet, with improved yields and lower cost of deposits. This has had a material impact on underlying revenue, which improved 42%1 when adjusting for the mortgage portfolio disposal. Encouragingly, the second half of the year delivered even stronger revenue and exit-NIM performances, providing ongoing momentum into 2022. There is still more to do, but our focus on delivering higher margins through unsecured and specialist mortgage lending, as well as tight cost control, is enabling transformational change. We remain committed to delivering on the strategy we set out, including supporting the communities in which we operate.”

1 Adjusts total underlying revenue by excluding loan income from the mortgage portfolio disposal announced in December 2020.

Outlook and Guidance

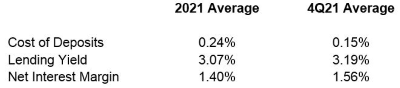

- The return to profitability gathered momentum in the year despite continued volatility in the macro-economic environment, with 4Q21 rates reflecting the Bank’s improved lending and deposit mix:

- Given the economic uncertainty resulting from the pandemic it is too early to provide medium term guidance. However, the Bank remains focused on execution and guides directionally for the next 12 months as follows.

Balance sheet: Higher growth than 2021 with continued focus on mix improvement.

Margin: A strong exit-NIM holds us in good stead for 2022 with continued focus on lending mix and improved yields as a result of the base rate rises, potentially tempered by higher cost of deposits.

Fees: Transaction-driven revenue streams influenced by the pace of recovery.

Costs: Low single digit % reduction in total underlying operating expenses. Non-underlying items are expected to be less than 20% of 2021 as remediation costs fall away.

Capital: Will operate in buffers but remain above regulatory minima. The Bank’s AIRB application is progressing.

A presentation for investors and analysts will be held at 8.30AM (UK time) on 23 February 2022.

The presentation will be webcast on:

https://onlinexperiences.com/Launch/QReg/ShowUUID=B1193A94-7E98-424E-B793-627EE9765A05

For those wishing to dial-in:

From the UK dial: 0800 358 9473

From the US dial: +1 855 85 70686

Participant Pin: 89517228#

URL for other international dial in numbers: https://events-ftp.arkadin.com/ev/docs/NE_W2_TF_Events_International_Access_List.pdf

Progress on strategic plan

Metro Bank continues to successfully deliver transformational change against all five pillars of the strategic plan set out in February 2020.

- Balance sheet optimisation: Improving mix, maximising risk-adjusted returns on capital. Decisive action taken in response to the changing environment. The mortgage disposal and RateSetter back book acquisition accelerated the shift to higher yielding assets followed by strong organic growth in consumer unsecured and specialist mortgages.

- Revenue: Margin expansion, NII growth and fee recovery. More products launched in store including RateSetter loans and insurance offerings. Government-backed lending through the Bounce Back Loan Scheme (BBLS) top-up and the Recovery Loan Scheme (RLS) to support communities. Investment in digital capability improves the multi-channel presence.

- Cost: Enabling sustainable growth. Investment in automation, IT platforms and the customer service proposition supports cost efficient growth. Agreed the acquisition of three further store freeholds at attractive yields and selectively closing three stores. Reduced central London office space and the hybrid working model utilises office space around stores.

- Infrastructure: Protecting the Bank. The enhancements to IT, regulatory reporting, financial crime, cyber security and digital channels all improve the Bank’s resilience and customer journeys.

- Internal and external communications: Delivering clear messages. Continued support for customers, colleagues and communities through the pandemic with a range of bank wide and hyper local brand and PR campaigns, as well as launching an SME marketing campaign showcasing the Bank’s FANS.

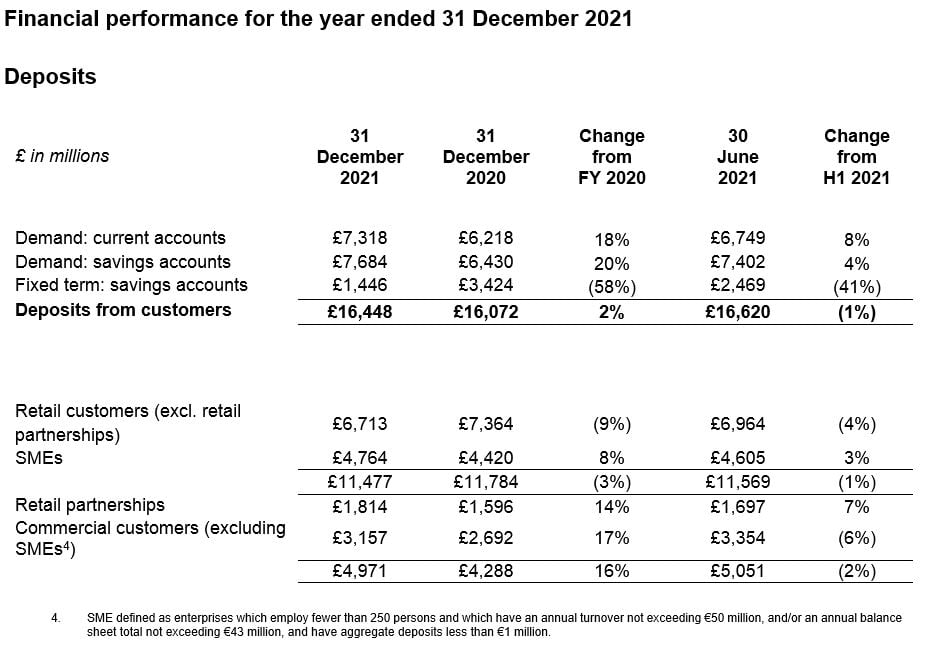

- Total deposits grew by over £370 million in the year to £16,448 million as at 31 December 2021 (31 December 2020: £16,072 million). Continued growth in current and savings accounts was offset by a £2.0 billion reduction in fixed term deposit (FTD) accounts following action taken to reduce prices. FTD accounts now make up 9% of total deposits (2020: 21%). Growth largely resulted from an increase in commercial deposits, reflecting customers’ continued preference for increased liquidity.

- Cost of deposits was 24bps for the year, a decrease of 41bps compared to 65bps in 2020, reflecting the managed roll-off of higher cost FTD accounts with a corresponding mix improvement in favour of non-interest-bearing current accounts and demand savings accounts, the Q4 2021 cost of deposits was 0.15%.

- Customer account growth of 0.3 million in the year to 2.5 million (2020: 2.2 million) reflects continued organic growth, with account growth from the RateSetter back book acquisition offsetting the managed reduction in fixed term deposits.

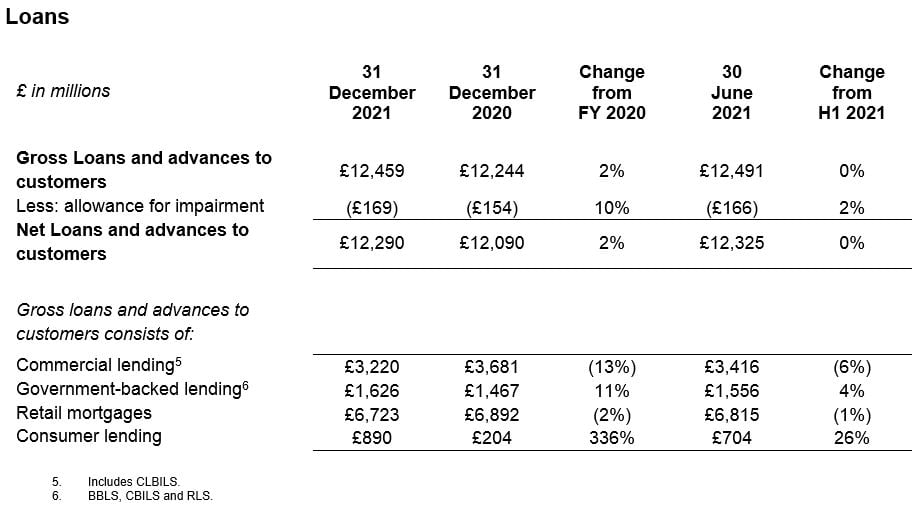

- Total net loans as at 31 December 2021 were £12,290 million, up 2% from £12,090 million as at 31 December 2020 reflecting growth in government-backed lending and the strong organic growth in consumer lending supported by the integration of the RateSetter platform, which offset the attrition of lower-yielding residential mortgages and commercial term loans.

- Commercial loans (excluding BBLS and CBILS) decreased by 13% during the year to £3,220 million as at 31 December 2021 (31 December 2020: £3,681 million), as large transactional lending rolled off.

- Government-backed lending increased by more than £150 million in the year to £1,626 million as at 31 December 2021 (31 December 2020: £1,467 million). Growth was primarily driven by BBLS top-up applications and Recovery Loan Scheme (RLS) lending.

- Retail mortgages remained the largest component of the lending book at 54% (31 December 2020: 56%), with mortgage applicants benefitting from enhancements to the existing mortgage offering and the launch of further specialist mortgage products during the year.

- Consumer lending increased to 7% of the of the total loan book from 2% as at 31 December 2020, resulting from the RateSetter back book acquisition and strong increase in organic lending as the RateSetter platform was rolled-out across all of Metro Bank’s channels. Consumer originations continue to average more than £50 million per month compared to less than £2 million per month a year earlier.

- Loan to deposit ratio held at 75% (31 December 2020: 75%) reflecting the impact of the mortgage portfolio disposal in December 2020 and capital constraints on lending.

- Cost of risk was 18bps for the year, a decrease of 68bps compared to 86bps in 2020, reflecting the more favourable macro-economic outlook. Non-performing loans increased to 3.71% (31 December 2020: 2.10%) driven by BBLS and a limited number of single name commercial exposures. The loan portfolio remains highly collateralised with average debt to value (DTV) of the residential mortgage book at 55% (31 December 2020: 56%), while DTV in the commercial book was 57% (31 December 2020: 56%).

Profit and Loss Account

- Net interest margin (NIM) of 1.40% is an increase of 18bps in the year (2020: 1.28%) and reflects an improved lending mix and lower cost of deposits, the Q4 2021 NIM was 1.56%.

- Underlying net interest income increased by 18% to £295.7 million (2020: £250.3 million), despite the mortgage portfolio disposal in H2 2020.

- Underlying net fee and other income increased 18% to £101.5 million (2020: £86.3 million). The lifting of COVID-19 lockdowns and other social restrictions in H2 led to growth in transaction-driven revenue streams.

- Total underlying operating costs increased 13% to £546.8 million (2020: £486.0 million) despite reducing 1% in the second half, reflecting a full year of RateSetter costs. ‘Change the Bank’ spend has now passed its peak, reducing 15% in the second half. The closure of three selected stores in Windsor, Milton Keynes and Earl’s Court also reduce cost run-rate into 2022, offset by the opening of a new store in Leicester in Q1 2022.

- Underlying loss before tax was £171.3 million, a 37% reduction from the £271.8 million loss in 2020.

- Statutory loss before tax of £245.1 million in 2021 (2020: loss of £311.4 million) includes remediation costs of (£45.9 million), and impairment of RateSetter peer-to-peer technology and the exit of three stores (£24.7 million), partially offset by the residual gain on sale in respect of the mortgage portfolio (£8.1 million). The remediation costs include (£5.4 million) relating to settlement of the PRA investigation and a (£5.3 million) provision for the FCA investigation.

- Statutory loss after tax of £248.2 million in 2021 (2020: loss of £301.7 million) after a £3.1 million corporation tax charge.

Capital, Funding and Liquidity

- Strong liquidity and funding position maintained, supported by the settlement of the mortgage portfolio disposal in February. As a result, the Bank’s Liquidity Coverage Ratio (LCR) remained elevated at 281% as of 31 December 2021 (31 December 2020: 187%). Whilst NIM dilutive, this excess liquidity is earnings neutral and in a rising rate environment has the potential to be earnings accretive.

In 2021, £3,250 million of Term Funding Scheme (TFS) drawings were refinanced into Term Funding Scheme with additional incentives for SMEs (TFSME), equating to total TFSME drawings of £3.8bn, maturing in 2024/2025.

- Common Equity Tier 1 (CET1) ratio of 12.6% (31 December 2020: 15.0%) compares to a minimum CET1 requirement of 7.6%7 and minimum Tier 1 requirement of 9.3%7.

- Total Capital ratio of 15.9% (31 December 2020: 18.1%) compares to a minimum requirement of 11.6%7.

- Total Capital plus MREL ratio of 20.5% (31 December 2020: 22.4%) compares to a minimum interim requirement of 20.5%7.

- As expected, the PRA have announced that from 1 January 2022 the following capital benefits will be reversed, as such the Bank’s capital ratios will reduce on 1 January 2022 to reflect these adjustments:

- Reversal of £64 million of relief provided through the EBA’s treatment of software assets, equivalent to 0.8% of CET1 and 0.7% of MREL.

- Amortisation of the IFRS9 Transitional Relief, equivalent to 0.3% of CET1 and MREL. - Total RWA as at 31 December 2021 was £7,454 million (31 December 2020: £7,957 million). The reduction reflects changes to the lending mix and settlement of a receivable related to the mortgage portfolio sale9. The result is a loan risk weight density of 48% as at 31 December 2021 (31 December 2020: 47%).

- Regulatory leverage ratio was 4.4%.

- Extension of HoldCo implementation deadline to June 2023 agreed with BoE.

Enquiries

For more information, please contact:

Metro Bank PLC Investor Relations

Jo Roberts

+44 (0) 20 3402 8900

Metro Bank PLC Media Relations

Tina Coates / Mona Patel

+44 (0) 7811 246016 / +44 (0) 7815 506845

Teneo

Charles Armitstead / Haya Herbert Burns

+44 (0)7703 330269 / +44 (0) 7342 031051

About Metro Bank

Metro Bank services more than two million customer accounts and is celebrated for its exceptional customer experience. It is the highest rated high street bank for overall service quality and best bank for service in-store for personal and business customers, in the Competition and Market Authority’s Service Quality Survey in February 2022. It was recognised as ‘Bank of the Year’ at the 2020 MoneyAge Awards and ‘Banking Brand of The Year’ at the Moneynet Personal Finance Awards 2021, received Gold Award in the Armed Forces Covenant’s Employer Recognition Scheme 2021 and won Best Open Banking Partnership – Commercial at the inaugural Open Banking Expo Awards 2021.

The community bank offers retail, business, commercial and private banking services, and prides itself on giving customers the choice to bank however, whenever and wherever they choose, and supporting the customers and communities it serves. Whether that’s through its network of 78 stores open seven days a week, 362 days a year; on the phone through its UK-based 24/7 contact centres; or online through its internet banking or award-winning mobile app: the Bank offers customers real choice.

Metro Bank PLC. Registered in England and Wales. Company number: 6419578. Registered office: One Southampton Row, London, WC1B 5HA. ‘Metrobank’ is the registered trademark of Metro Bank PLC.

It is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Most relevant deposits are protected by the Financial Services Compensation Scheme. For further information about the Scheme refer to the FSCS website www.fscs.org.uk. All Metro Bank products are subject to status and approval.

Metro Bank PLC is an independent UK bank – it is not affiliated with any other bank or organisation (including the METRO newspaper or its publishers) anywhere in the world. Please refer to Metro Bank using the full name.