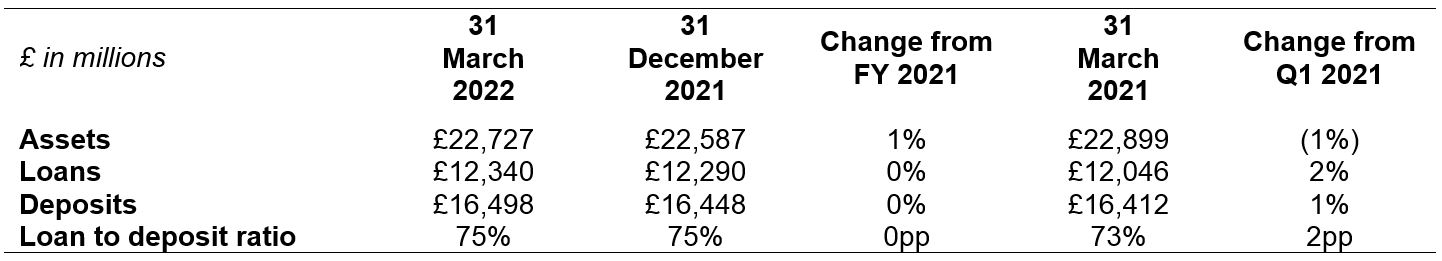

Total deposits of £16,498 million remained flat during Q1 with continued mix improvement. Growth across business and retail customers’ instant access and current accounts continued as well as a further reduction in higher-cost fixed term deposits, in line with the Bank’s strategic plan. Prioritising the high-quality deposit mix over expansion remains the focus during 2022.

Q1 total net loans were also broadly flat over the period at £12,340 million. Continued strong growth in consumer lending and specialist mortgages offset the attrition of lower-yielding residential mortgages and commercial term loans. Credit impairments remain benign. The loan to deposit ratio in Q1 remained flat at 75% following stable loan and deposit balances, while the year-on-year increase reflects the higher loan growth.

Delivery of the Bank’s strategic plan remains on track with continued momentum in underlying performance through the first quarter of 2022. Management remains focused on returning the Bank to profitability by delivering higher margins through unsecured and specialist mortgage lending, as well as tight cost control. The Bank continues to operate within its MREL capital buffers1.

1Based on current capital requirements excluding any confidential PRA buffer, if applicable.

Daniel Frumkin, Chief Executive Officer at Metro Bank, said:

“Metro Bank has delivered a solid quarter, as we continue to accelerate the shift of our balance sheet, with improved yields achieved from specialist mortgages and unsecured lending, alongside lower cost of deposits and tight cost control. We remain focused on executing our plans and returning the Bank to profitable growth whilst supporting our customers, communities and colleagues in what continues to be a changing macro-economic environment.”