Vulnerable customers

Mortgage Intermediaries guide to understanding and providing extra support for vulnerable customers

This website is for FCA Authorised Intermediaries only.

Jump to:

Understanding vulnerability Extra support Identifying vulnerability

What to do when identifying a vulnerable customer Hidden Disabilities Sunflower Scheme

It is important to recognise that anyone can be or become vulnerable at any point in their life, and some customers may be at a higher risk of harm than others. Metro Bank uses the same definition as the FCA:

A vulnerable customer is someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.

Metro Bank is able to offer extra support to help make banking easier for customers. With their consent, we can make a note on their accounts about any extra support they need. This means they won’t need to mention it again, and our colleagues can make sure we always offer the right help in the future.

If the customer is happy to discuss and has given their permission, please ensure you record that the customer is vulnerable within the application notes, along with any supporting information.

Our Mortgage Servicing Team will give the customer a call back during onboarding to confirm the additional support that we will provide. This enables us to offer appropriate support to your customer throughout their mortgage journey.

Disclosure of vulnerabilities will not negatively affect their application but will help us to make sure our customers get the best service both during the mortgage application process and after completion.

For an existing Metro Bank customers who are in financial difficulty and who need specialist support, please advise the customer to call the mortgage servicing team on 0345 319 1200. If you’d like to deal with this on their behalf, we will need a signed letter from your customer giving authority for you to do so, or for the customer to be present when you call.

Keep in mind that:

- Some customers’ personal circumstances can be permanent. For example, they may have a learning difficulty which means they will always need us to make reasonable adjustments when serving their mortgage needs

- Other customers may have a temporary personal circumstance, which means they could need additional support for a set period of time. For example a victim survivor of financial abuse may require help regaining control of their finances and independence

- Customers can also experience multiple drivers of vulnerability which means they have more complex needs and are more susceptible to harm. For example a customer that has low financial resilience may also struggle with their mental health.

Did you know?

Over 800,000 people are living with varying degrees of Dementia in the UK and this is expected to double over the next 40 years.

And just under half of UK adults have a numeracy attainment age of 11 or below.

Every 2 minutes someone in the UK is diagnosed with cancer

16% of working adults have a disability.

1 in 7 adults has literacy skills that are expected of a child of 11 years or below.

In any given year, one in four adults experiences at least one mental disorder.

Understanding vulnerability

There are four drivers of vulnerability, these can be permanent or temporary, these drivers mean that someone is potentially more susceptible to harm. Customers may also experience more than one driver of vulnerability, which may increase their risk of experiencing harm. Not all customers will let us know about their personal circumstances, but it is important that you are able to identify signs that someone may need extra support.

Health

Health

Health conditions or illness that affect the ability to carry out day to day tasks

- Physical disability

- Severe or long term illness

- Hearing or visual impairment

- Poor mental health

- Addiction

- Low mental capacity or cognitive impairment.

Resilience

Resilience

Low ability to withstand financial or emotional shocks

- Low or erratic income

- Over-indebtedness

- Low savings

- Low emotional resilience.

Life event

Life event

Negative life events

- Income shock i.e. retirement, job loss, redundancy or reduction in hours

- Bereavement

- Relationship breakdown

- Domestic abuse

- Caring responsibilities

- People with non standard requirements such as people with convictions, care leavers, refugees or asylum seekers.

Capability

Capability

Low knowledge of financial matters or low confidence in managing money (financial capability). Low capability in other arears such as literacy or digital skills

- Low knowledge or confidence in managing finances

- Poor literacy or numeracy

- Low English skills

- Learning difficulties

- No or low access to help or support.

Extra support

Metro Bank is able to provide extra support to its customers to help make banking easier, and we can make a note of the support so that the customer won’t need to tell us again in the future

We will always let the customer know how we will record this information, and ask for their consent before we make a note on their customer profile. Customers will have complete control over this information and can change or remove it at any time

Help me understand

Give me flexibility

Keep me safe

Make it easy for me

Give me the skills

Give me specialist support

Identifying vulnerability

Metro Bank seeks to help all customers secure the mortgage they want, but it’s important that they understand the long-term commitment and if it’s right for their circumstances.

You should look out for any evidence that a potential customer could be vulnerable and take extra care that they are not entering into a commitment which they don’t understand or may not be in their best interests.

Vulnerable customers may require further help with their mortgage application and the following information in this document will provide you with guidance on what you should do in these cases

You can use BRUCE to help identify vulnerability when you are interacting with your customers:

- Behaviour and talk: is the customer acting out of character? Look for indicators of vulnerability through the customer’s behaviour and speech

- Remembering: is the customer experiencing problems with their memory or repeatedly requesting information? Is the customer confused when asked basic questions such as personal details?

- Understanding: is the customer showing they understand all of the information they are being provided with? Are they able to replay that information to you in a coherent manner? This would included the customer showing they understand the potential consequences both of making or not making their decision

- Communicating: can the customer communicate their thoughts and questions and are they ultimately able to make an informed decision?

- Evaluating: can the customer weigh up the information options open to them to make an informed decision?

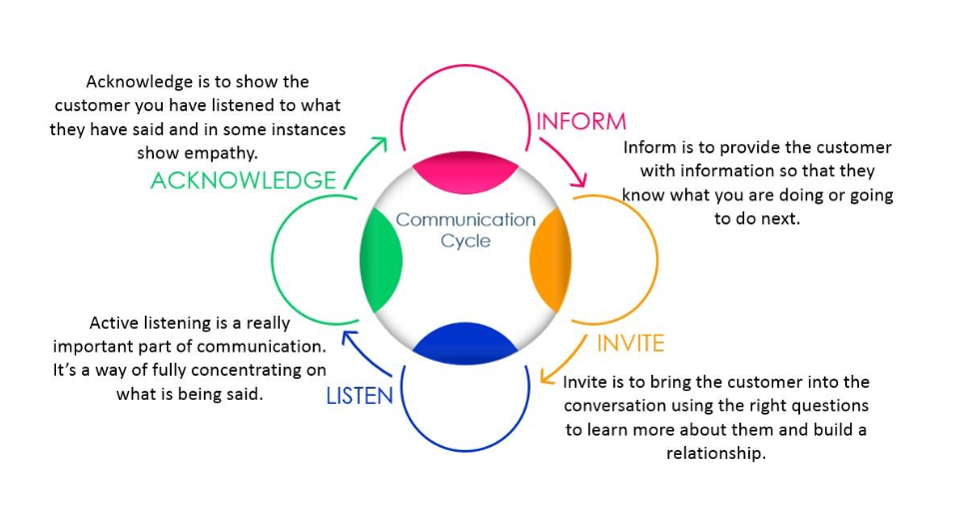

Communication cycle

When it comes to having a conversation with customers who may need additional support, we suggest using the communication cycle. Below is an image of the communication which shows the 4 stages and their definition:

The communication cycle allows a two-way conversation so that the customer is fully involved and gives them the opportunity to express their views. The communication cycle has a huge impact when it comes to vulnerable customers as it allows the customer into the conversation by asking further questions if needed and ensures that we are listening to exactly what is being said so that we are fully informed. We are then able to use the acknowledge section to confirm our understanding and show the customer we have listened.

What to do when identifying a vulnerable customer

You can use TEXAS to help you to structure your conversation where a customer has disclosed personal information indicating they need additional support.

- T - Thank them, as it may have been a big step for the customer to share their situation. It’s important to acknowledge this and put them at ease

- E - Explain any information will be captured and used to support them in identifying and recommending a suitable product or service, and may reduce the need for them repeat to themselves in the future

- X - The customer must provide explicit consent and confirm they’re comfortable for you to record and share any sensitive information about their circumstances

- A - Ask some additional questions, for example, do you require any additional time to make a decision to proceed? Is there any additional support you would like?

- S - Signpost any potential support required, e.g. are there any appropriate third party support groups or charities which may help the customer?

At Metro Bank, we are all about providing unparalleled levels of service and convenience to our customers; this means identifying when customers are vulnerable or are at risk of becoming vulnerable.

If the customer is happy to discuss and has given their permission, please ensure you record that the customer is vulnerable within the application notes, along with any supporting information.

Our Mortgage Servicing Team will give the customer a call back during onboarding to confirm the additional support that we will provide.

Disclosure of vulnerabilities will not negatively affect their application but will help us to make sure our customers get the best service both during the mortgage application process and after completion.

For an existing Metro Bank customers who are in financial difficulty and who need specialist support, please advise the customer to call the mortgage servicing team on 0345 319 1200. If you’d like to deal with this on their behalf, we will need a signed letter from your customer giving authority for you to do so, or for the customer to be present when you call.

Hidden Disabilities Sunflower Scheme

We are proud to support the Hidden Disabilities Sunflower scheme. Our commitment to inclusivity means recognising that not all disabilities are visible and ensuring that everyone feels understood and valued in their environment.

There are two types of Sunflower lanyards:

- The green lanyard with sunflowers is worn by a person who has a disability or condition that might not be apparent right away.

- The white lanyard is for supporters of the Hidden Disabilities Sunflower. Wearing the supporters’ lanyard lets Sunflower wearers know that you understand what the Sunflower stands for.

If you or your customer wears the Sunflower, Metro Bank are here to provide the assistance, time, or additional support you may need. By recognising the Sunflower, we aim to create a welcome space for individuals with hidden disabilities and their families.

Find out more about the Hidden Disabilities Sunflower scheme

Where to get help

More information about the extra support Metro Bank can provide can be found on our webpage dedicated to extra support for our customers.

There are many organisations that can provide help and support, too. Here’s a list of some of them and their contact information:

Age UK

0800 055 6112

Alzeimer's Society

0300 222 1122

Citizens Advice

03444 111 4444

Cruse Bereavement Care

0808 808 1677

Macmillan Cancer Support

0808 808 0000

Mencap

0808 808 1111

Mind

0300 123 3393

Samaritans

116 123

Step Change

0800 138 1111

Victim Support

0808 168 9111

Frequently asked questions

What is a vulnerable customer?

A vulnerable customer is someone who, due to their personal circumstances, is especially susceptible to harm - particularly when a firm is not acting with appropriate levels of care.

This may be a customer with a physical impairment or limited understanding of the English language. Sometimes life events such as new caring responsibilities, a bereavement, divorce, or redundancy can lead to a customer becoming vulnerable.

Anyone can become vulnerable at any time and this may be temporary or permanent.

Vulnerable customers may be at increased risk of detriment if their needs are not properly supported throughout their relationship with us. Therefore, it’s important you are able to identify a prospective Metro customer who may be vulnerable.

What should you do if you identify a vulnerable customer?

At Metro Bank, we are all about providing unparalleled levels of service and convenience to our customers; this means identifying when customers are vulnerable or are at risk of becoming vulnerable.

If the customer is happy to discuss and has given their permission, please ensure you record that the customer is vulnerable within the application notes, along with any supporting information.

What other support is available for vulnerable customers?

There are many charities and organisations that support customers with vulnerabilities such as the Citizens Advice Bureau (www.citizensadvice.org.uk/). Metro Bank has partnered with the following organisations:

Where can I find more information on how to identify and support customers that are vulnerable?

You can find out more on our dedicated Vulnerable customers page.